I. INTRODUCTION

The above temporary law was passed in parliament on 7 Apr 2020 due to the urgency and aims to grant temporary relief for six months, and if required may be extended for another 6 months, to those who cannot fulfil contractual obligations, because of the Covid-19 pandemic. The Act’s intention is to provide relief without too much alteration to contractual rights.

The Act was amended again due to the necessity on 5th June 2020. The amendment to the Act was needed to stop the strict enforcement of contractual rights that could damage the economy.

Working of the Act is as follows:

CATEGORIES OF CONTRACTS COVERED BY THE ACT

1. Leases or licences for non-residential immovable property (e.g. factory premises).

2. Construction or supply contracts (e.g. contract for the supply of materials).

3. Event contracts involving the provision of goods and services (e.g. venue or catering for

weddings, business meetings).

4. Tourism-related contracts (e.g. hotel accommodation bookings).

5. Certain secured loan facilities granted by a bank or a finance company to SMEs.

Proposed Relief Period

a. Covers obligations to be performed on or after Feb 1, 2020 and excludes contracts entered into on or after March 25, 2020.

b. Would last six months from the commencement of the Act and may be extended for up to a year from the commencement of the Act.

1. Leases or licences for non-residential immovable property

Rent deferment – Move gives tenants short-term liquidity but doesn’ t mean they don’ t

have to pay rent

• The deferment of rent payment is meant to give tenants breathing space and short-

term liquidity, that it does not mean tenants do not have to pay rent. Those who can

make rental payments must continue to do so.

• The legislation prevents landlords from terminating a lease or commencing legal action because a tenant cannot pay rent.

• The laws provide for disputes to be settled by assessors appointed by the Ministry of

Law.

2. Construction or supply contracts

• For construction contracts or supply contracts, where obligations cannot be performed due to Covid-19, the contractor will not be liable for liquidated damages, nor for delays or non-supply of goods.

3&4. Event contracts involving the provision of goods and services & Tourism-related contracts

Event deposits protected, but need not be refunded at once

• New laws have been passed that will protect deposits for event-and tourism-

related contracts from being forfeited if the booking is affected by the coronavirus

outbreak.

• The Act will cover events that were scheduled to be held on or after Feb 1, such as

wedding banquets, business meetings or conferences. It also includes contracts for

accommodation or entertainment related to tourism. If an event cannot proceed

due to the outbreak, any deposits forfeited will be restored once a claim has been

lodged. Non-compliance would be an offence.

5. Certain secured loan facilities granted by a bank or a finance company to SMEs.

• Under the Bill, if a contractor is not able to perform due to a Covid-19 event

between Feb 1 and the end of the prescribed period, that period should be

disregarded in determining the period of delay in performance. The law also

covers certain types of loan facilities, including secured loans given to small and

medium-sized enterprises (SMEs) with a turnover that does not exceed $100

million in the latest financial year.

• If an SME is unable to repay its instalments due to a Covid-19 event, then some

legal actions cannot be taken against it.

II. TEMPORARY RELIEF FROM CONTRACT OBLIGATIONS HIT BY COVID-19

Relief from bankruptcy

The Debt Repayment Scheme for individuals to avoid being made a bankrupt has been raised from $100,000 to $250,000. This allows more people to enroll in the scheme.

The aim is to protect the vital interests of people by stopping the strict enforcement of certain contractual rights that could damage the whole economy.

If a tenant still cannot pay rent due to the Covid-19 pandemic, the lease cannot be terminated just because he is in arrears. And he also cannot be sued for the rent. This is helping people hit hard by the crisis but it does not mean that all tenants do not have to pay rent. Those who can make payments must continue to do so.

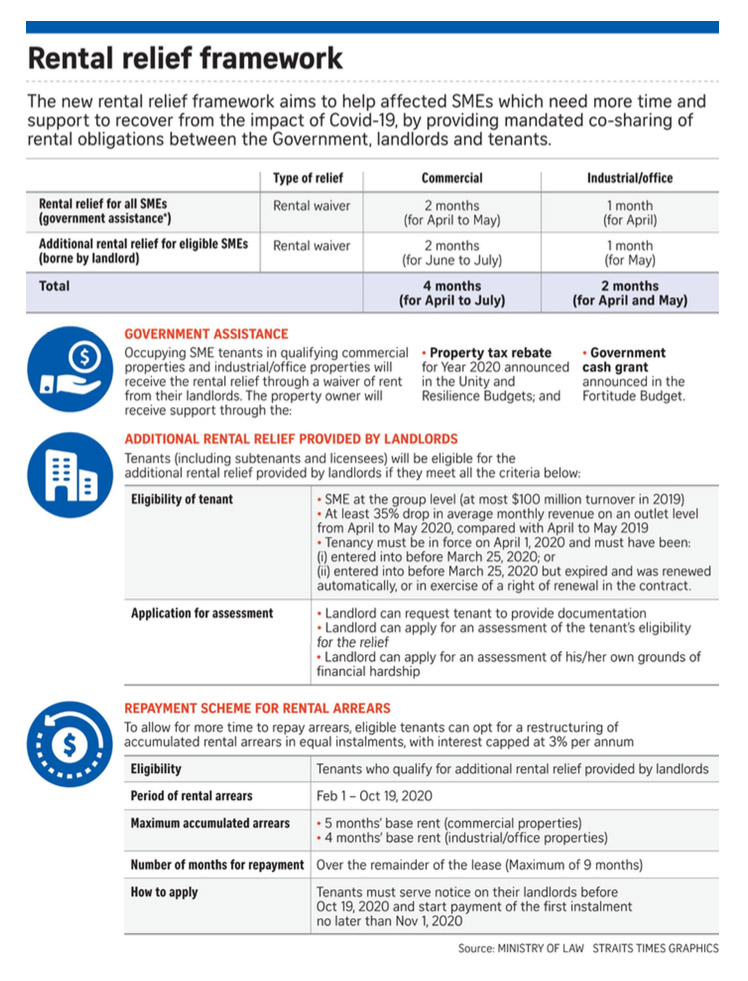

The Bill would grant eligible SME tenants in commercial properties that have suffered a significant revenue drop a total of four months of rental relief. This would be shared equally between the Government and the landlords.

SME tenants in industrial and office properties would also be given some relief in the Bill. It will be disbursed by the Inland Revenue Authority of Singapore to property owners from the end of July. Landlords are required to pass on the benefit to their SME tenants. This should help more SMEs, which account for 72 per cent of employment here, stay afloat.

The new Bill will also cover provisions on temporary relief from onerous contractual terms such as excessive late payment interest or charges. It will also let tenants repay their arrears through instalments.

The Bill will also temporarily raise the monetary threshold for bankruptcy to S$60,000 from S$15,000 usually, and raise that for insolvency to S$100,000 from S$10,000 usually. The statutory period to respond to demands from creditors will be temporarily lengthened to six months, from 21 days usually.

Directors will be temporarily relieved from the obligation to prevent their companies from trading while insolvent, if debts are incurred in the ordinary course of business.

It added that the contractual rights of banks are not affected, other than the right to start legal action for a default on a relevant loan, which is suspended for the six-month period. Banks’ contractual right to charge fees and interest for non-payment or late payment of loan obligations due is unaffected.

Landlords will have to unconditionally pass on their property tax rebate in full to their tenants.

Landlords are given 30% rebate on their property tax paid for the year 2020 in this budget, which will work out to about one month of rent for most properties. Those who fail to do so without reasonable excuse can be fined up to $5,000 under the Act.

Individuals or businesses unable to meet their contractual obligations because of the coronavirus situation and whom want to claim relief must give notice of relief to the other party. If prohibited actions under the law are taken against individuals or businesses despite a notice of relief, it will be an offence punishable with a fine.

Parties that cannot agree can seek help from the law, which will appoint a panel of assessors – professionals from the legal, accounting, financial and other industry sectors – to decide on what would be a just and equitable outcome for both parties.

The process will be fast and will take no more than 5 days at no cost to either party. The final decision by the assessor cannot be appealed against in the court. At the end of the relief period, the individual or business must fulfil the original contractual obligations.

Relief for property buyers with payment problems

The Covid-19 (Temporary Measures) Act, which kicked in on April 20 has been extended to the purchase and lease of homes. Only agreements between home buyers and developers for private housing and the HDB are covered. And these contracts must have been entered into before March 25, with payments due on or after Feb 1. Agreements between individuals are not covered. Home buyers can opt to defer progress payments and down payments to developers and the HDB from Feb 1 until Oct 19.