GRANTS AND TAX BENEFITS FOR SMALL & MEDIUM ENTERPRISES (SMEs)

- In order to make the locally grown SMEs to scale up and be globally competitive, enhanced tax deductions, cash payouts are made to be innovative, digitalize their operations and go beyond the shores of Singapore (internalize)

- SMEs are defined as follows:

The firm or companies are registered and operating in Singapore. The annual turnover are less than S$100M, employ less than 200 staff and importantly local share holding of 30% in the company (Both Singapore Citizen & Permanent Residents)

- ENTERPRISE FINANCE SCHEME

The Enterprise Financing Scheme (EFS) is a comprehensive tool to enable Singapore enterprises to access financing more readily across all stages of growth.

It covers seven areas to address enterprises’ financing needs: green loans, working capital loans, fixed asset loans, venture debt loans, trade loans, project loans, as well as Merger & Acquisition loans.

Various government financing schemes streamlined under one umbrella to support various stages of your business growth. Government risk sharing with participating finance institutions. The EFS aims to provide targeted financing instruments to better support Singapore SMEs throughout their various phases of growth.

- ENERGY EFFICIENT GRANT

Energy Efficiency Grant (EEG) which provides funding for the implementation of pre-approved, energy-efficient machinery by SMEs in the food services, food manufacturing, and retail sectors. In Budget 2023, the EEG was extended by a year till March 31, 2024.

- ENTERPRISE INNOVATION SCHEME – Companies here that invest in innovation, such as research and development (R&D), will be able to enjoy more tax deductions, as part of a new scheme to encourage businesses to press on with such efforts.

Smaller firms, which may pay little or no taxes, will also have an option to get a non-taxable cash payout under the Enterprise Innovation Scheme.

Currently, businesses enjoy tax deductions of up to 250 percent on four types of innovation-related activities. These tax deductions will be raised to 400 percent on each of these activities with a new activity added to the list. The five activities are :

- R&D conducted in Singapore.

- Registration of intellectual property (IP) including patents, trademarks and designs

- Acquisition and licensing of IP rights

- Innovation carried out with polytechnics and the Institute of Technical Education (ITE)

- Training via courses approved by Skills Future Singapore which are aligned with to the Skills Framework.

The expenditure on each activity will be capped at $400,000, except for innovation carried out with polytechnics and ITE, which has an expenditure cap of $50,000.

This means that for a business which spent $1000 on R&D and another $1000 on registration of IP, it will be able to offset a total of $8000 from its taxable income.

Start-ups and small and medium-sized enterprises (SMEs) and other small businesses that have yet to turn profitable, and hence pay little or no tax, will stand to benefit from a new cash conversion scheme, given that they are unable to maximize the benefits from tax deductions.

These businesses can opt to convert 20 percent of their total qualifying expenditure across all five categories per year of assessment into a cash payout of up to $20,000. This means that up to $100,000 of qualifying expenditure will be defrayed. Applications of these cash payouts are to be submitted together with the filing of businesses’ income tax returns.

- SMES COINVESTMENT SCHEME- Separately, efforts continue to help local enterprises scale up and be globally competitive. The Government has, for instance, been mobilizing investments into SMEs through Heliconia Capital.

Heliconia Capital is a subsidiary of Singapore’s investment company Temasek Holdings. It focuses on supporting and investing in growth-oriented small and medium-sized Singapore companies.

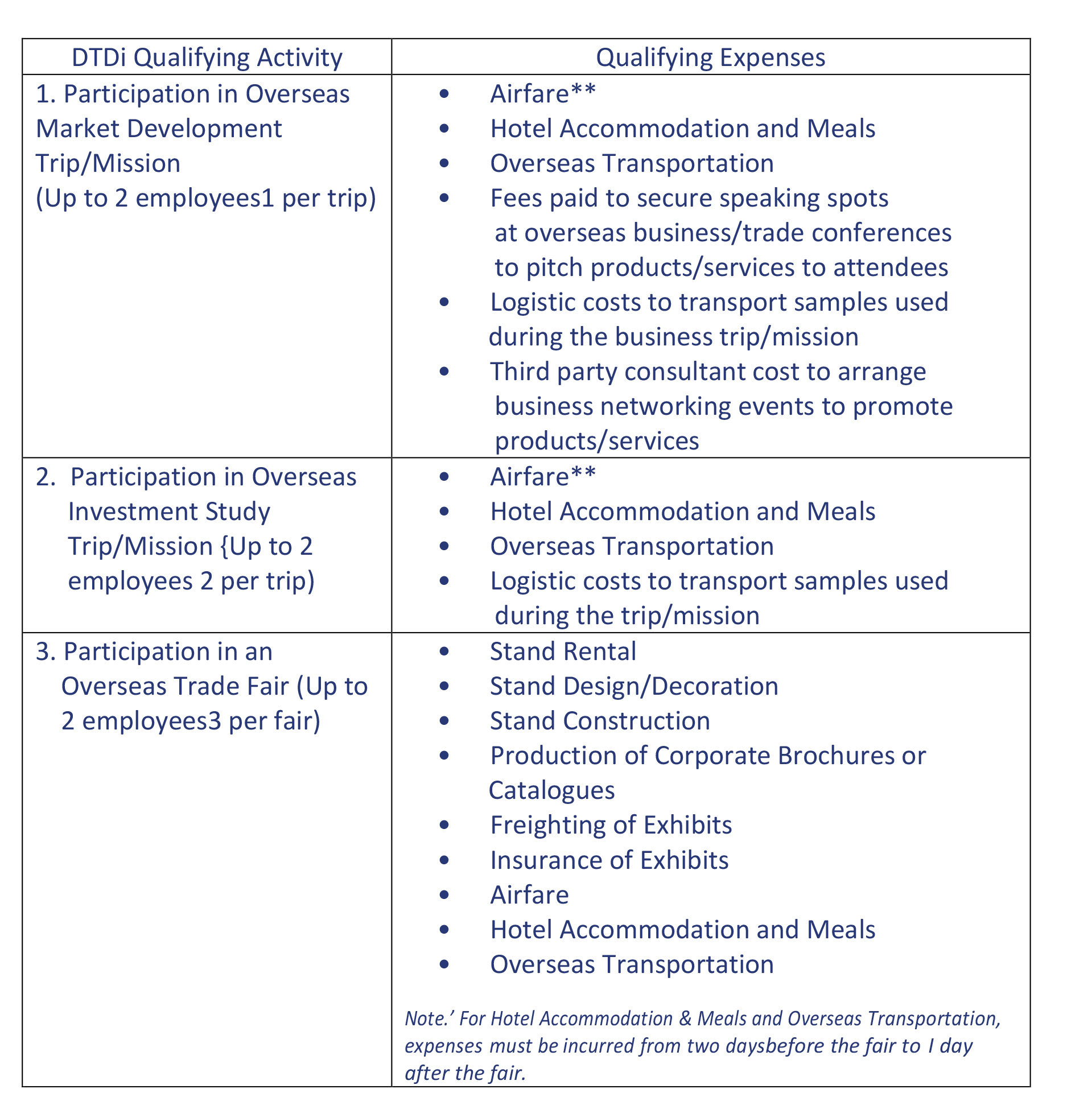

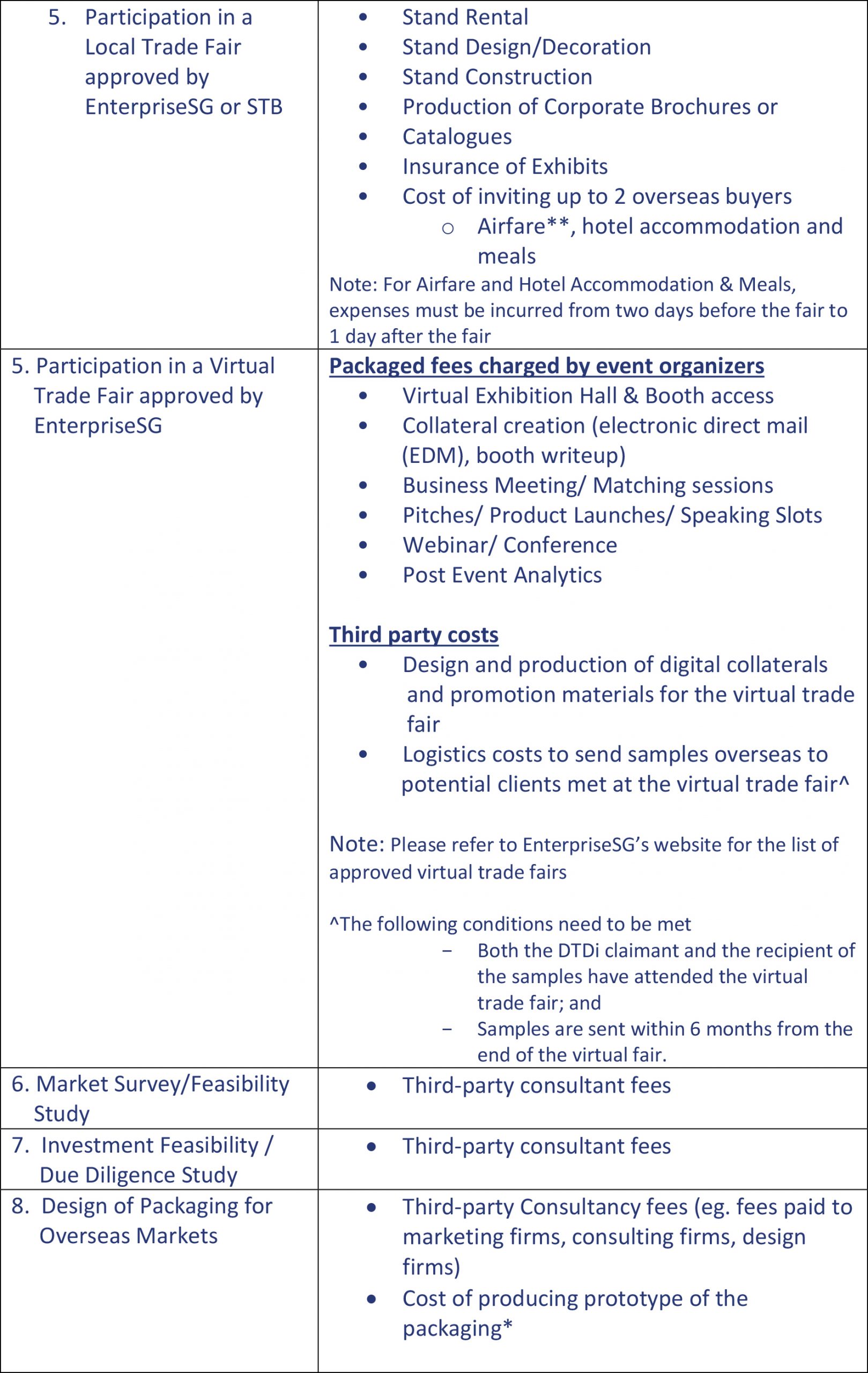

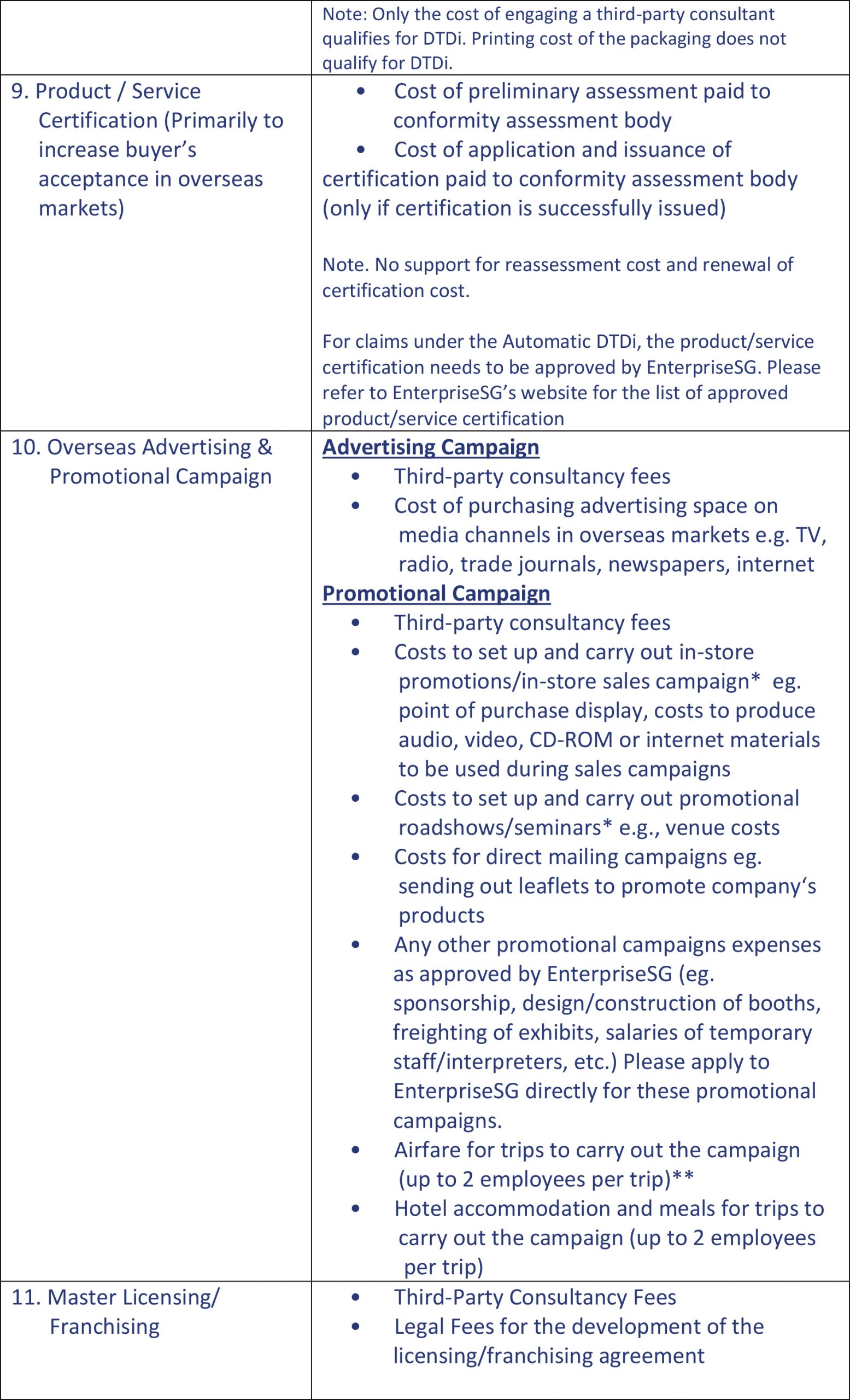

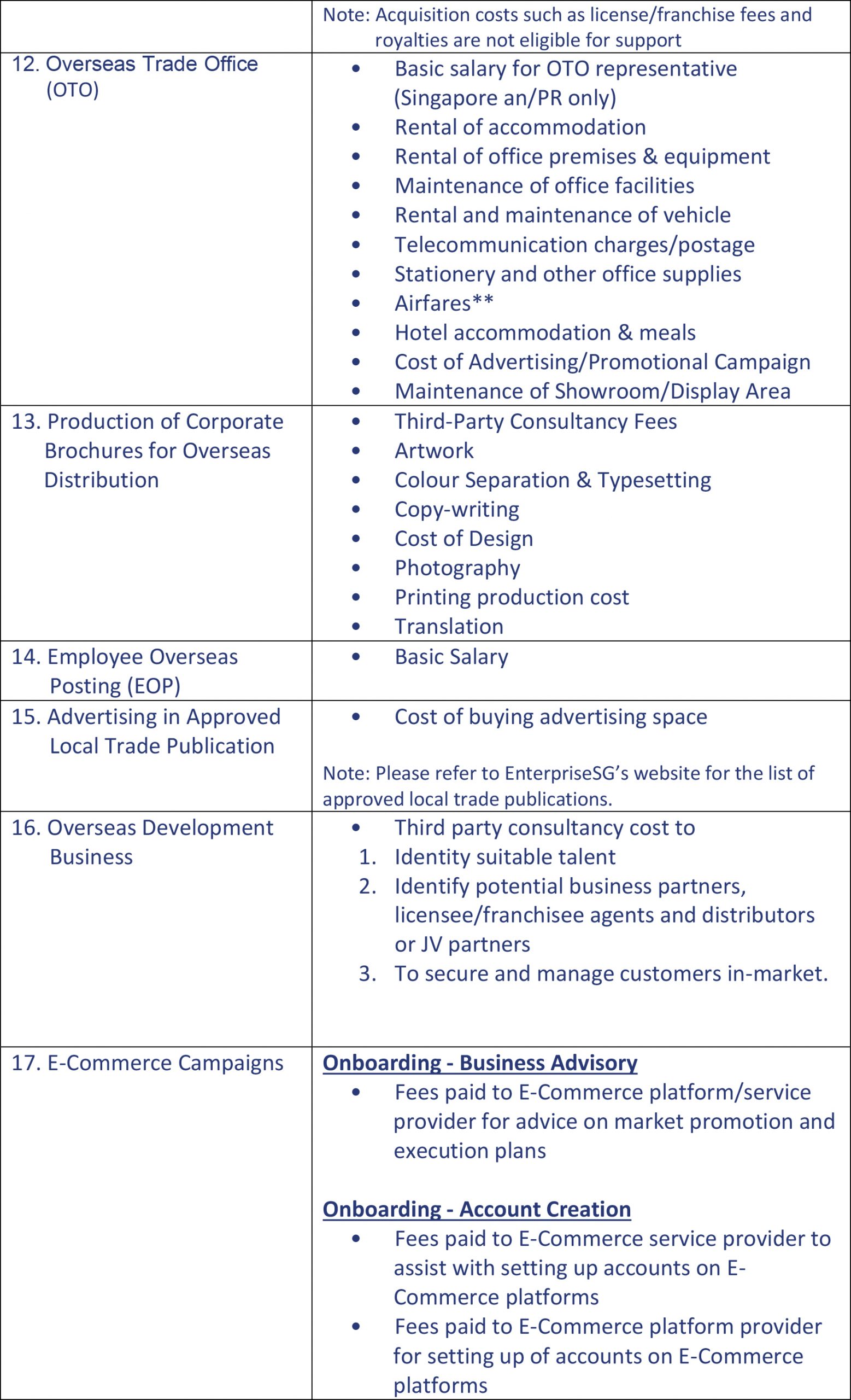

The double deduction for expenses incurred are taken from ENTERPRISE SINGAPORE and is stated below:

¹ When a company sends three of its employees to participate in an overseas trip (same objective and duration) DTDi will be granted up to two employees. The third employee can be considered for support on case-by-case basis if the employee meets with different customers in another city in the country or follow-up with potential customers.

² When a company sends three of its employees to participate in an overseas trip (same objective and duration) DTDi will be granted up to two employees. The third employee can be considered for support on case-by-case basis if the employee meets with different customers in another city in the country or follow-up with potential customers.

³ When a company sends 3 of its employees to participate in an overseas trade fair/mission, DTDi will be granted in respect of 2 employees. Expenses incurred by the company on the third employee will continue to enjoy a 100% tax deduction (provided they qualify for deduction under Section 14 of the Singapore Income Tax Act).

*Costs associated with free gifts, hiring of promoters, printing of T-shirts for promoters and conducting surveys are excluded.

** Airfare includes airport tax, fuel surcharge, airfare transaction fees and visa fees. It excludes GST/CESS/Carrier Surcharge/Bank Charges/Insurance Amendment Fees/Excess Baggage. Qualifying expenses on airfare, hotel accommodation & subsistence allowances (meals only) are based on an incurred basis. The support is up to a max of two company’s representative trip.

Please note that non-eligible expenses include out-of-pocket expenses, telecommunication cost, general software eg. Microsoft Word, GST, bank interest, souvenirs, cash incentive, sponsorships, freebies, food and beverages for staff, printing of business cards. The list is not exhaustive.

All costs incurred/recharged back to the Singapore business. EnterpriseSG will request for supporting documents (eg. quotation) for eligible expense items that are S$100,000 and above.

If a business is unable to fully utilize the cap of $150,000 for a YA, it cannot bring forward the unutilized part of the next YA.