Singapore Private Family Trust

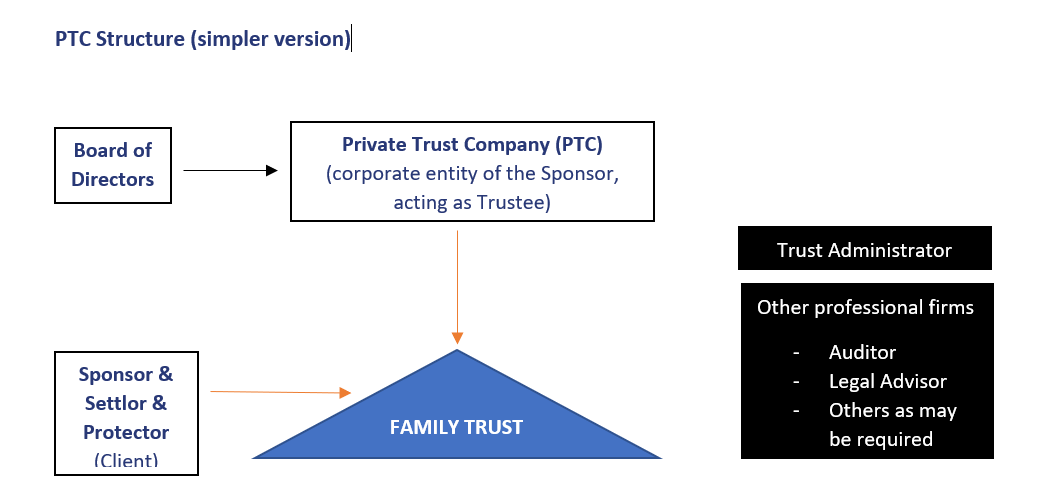

Singapore Private Trust Company (“PTC”) can be used as a private investment structure by business families/ ultra-high net worth individuals (“Settlor” or “Sponsor”) for managing family wealth. PTC is a private corporate entity established in Singapore solely for the purpose of acting as trustee in relation to a specific trust or trusts for a single family.

The PTC structure will also help the Sponsor to retain ownership and control over the family assets instead of transferring it to an independent Trustee (as is required in a traditional trust arrangement). The operational efficiency of the family trust can be achieved by putting in place at the board level certain processes for its day-to-day operations and running it like a professional organisation.

The shareholding and directorships in the PTC can be structured to create control over the trust assets in a manner desired by the Sponsor. Only the beneficiaries (which can be same or different class of people but must be related to the Settlor) are entitled to the distributions of the Trust Funds (except that the beneficiary of the residual estate of the Settlor may be a charity).

Singapore PTC

PTC bears the features of a company (such as corporate management and limited liability) and yet, is the trustee for specific family trusts

- Acts as “dedicated’ trustee for a specific trust or a few trusts.

- Must have at least one director who is “ordinary resident” in Singapore

Benefits in general

- Settlor can formulate the succession to board

- Decisions can be taken in a faster manner

- Can maintain more control and influence over the management of the family assets.

- Flexibility in structuring and yet maintain governance and discipline in a corporatized manner.

- Handhold and coach younger members of the family on the broader management of family wealth.

- Puts total control over management of assets in hands of competent persons identified by the Settlor.

- PTC being a legal entity can be perpetually; passing to subsequent generations.

Board

- A board of directors and if required, sub committees.

- Usually consist of the Settlor, independent experts, Family members and trust advisers.

- Composition of the Board can be changed at any time to keep up with changes in the family circumstances.

- Can inculcate discipline and transparency in the management of family wealth in a well-documented manner by adopting high standards of corporate governance.

Assets of the trust will be held in the name of the PTC as the legal owner and for the benefit of the beneficiaries.

The usual legal documents include the Constitution of the PTC, Trust Deed, appointment letters of directors and professional parties who provide specific service to the private family trust.

In Singapore, PTCs are exempted from seeking trust licensing, but are required to mandatorily appoint a trust administrator to perform due diligence checks to ensure compliance with anti-money laundering regulations. A suitable process must be put in place to conduct day to day operations of the family trust.

If the PTC is structured suitably and meets with certain requirements, it may qualify for exemption from taxation in Singapore. Having economic substance in Singapore and value add to Singaporean economy is one of aspects which are relevant for the above.