FAMILY OFFICES

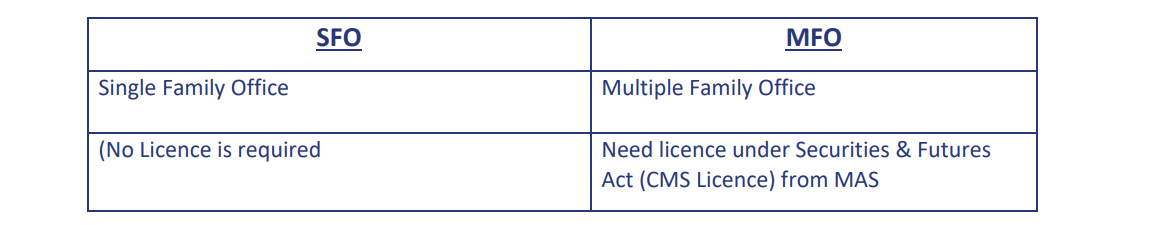

A

B

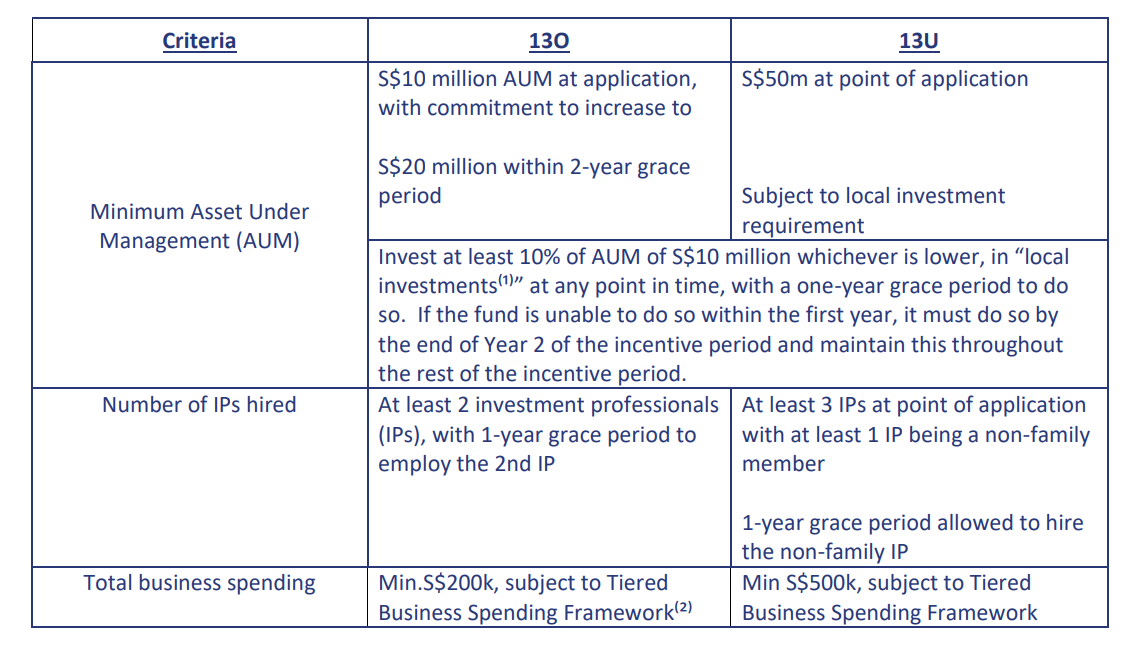

Note: Local investments refer to (i) equities, REITS or Business Trusts listed on Singapore-approved exchanges . (ii) qualifying debt securities, (iii) funds distributed by Singapore-licensed/registered fund managers or financial institutions, (iv) private equity investments into non-listed Singapore-based incorporated companies (eg. Start-ups) with operating business(es) in Singapore.

The recent requirements make SFO’s to –

- Uplifting the standards of SFO in anticipation of upcoming demands and challenges.

- Deepening and broadening of skillsets within SFOs.

- Sufficient resources for sustainability and robust operations of SFOs.

Implications of recent regulatory developments – MAS (Application Criteria and Process for Family Offices (updated 01.12. 2022)

Can a fund invest in the UBO’s operating business?

- Fund vehicles are not considered to be holding controlling stakes in related operating entities:

- fund vehicle does not hold >25% of total outstanding shares of the operating business permanently.

- UBO/family’s shares of the operating businesses do not take up >50% of the total AUM across all fund vehicles owned by the UBO

- Fund vehicles, on average, meet AUM requirements after excluding shares of the family’s operating businesses, per fund vehicle.

- The fund vehicle is not required to consolidate the results of the operating businesses in its accounts; and

- The fund vehicle is not liable to any top-up tax imposed by any jurisdiction as a response to tax exemption enjoyed by the fund vehicle

Exchange of information is extending to CRYPTO – ASSETS

The OECD has recently released a public consultation on Crypto-Asset Reporting Framework and amendments to CRS

Amongst the proposals, the OECD is developing a new global tax transparency framework which provides for the automatic exchange of tax information on transactions in cyrpto-assets in a standardized manner

What does it entail?

- The definition of cyrpto-asset holdings is wide, covering not only crypto-currencies but also NFTs

- Once implemented, crypto-assets holdings would be subject to similar reporting obligations like CRS

- Crypto-service providers are intermediaries would have to be mindful of additional reporting obligations

- Crypto-service providers would also be require additional information from users.

- Existing FIs that deal with crypto-assets may also have additional requirements to implement new reporting frameworks for crypto-assets reporting?

FAMILY OFFICE -DUE DILIGENCE

- The authorities have access to greater amounts of data on financial assets and business assets with more effective technology and tools, leading to greater scrutiny by home country tax authority.

- With data collection mechanisms in place, tax authorities are better equipped

- Initiatives such as BEP 2.0 leverages off the data pools amassed from CRS and CbC reporting

- Understand their “tax residency” position

- Familiarize with reporting obligations (e.g., whether the reporting for FATCA and CRS is done via external financial institutions or through the family’s owns structures)

- Have handle risks of complex structures

- Proper structing of offshore investments or operations

- Need to periodically review offshore structures

- Where restructuring is required , seek legal and tax advice

- Supporting documentation must be maintained for all offshore structures in anticipation of queries from authorities

- Families with business assets and with shares in global MNEs should align CRS with Cbc reporting

Singapore-based SFOs : Entering a new era – MAS circular dated 19-09-2022

“Family refer to individuals who are lineal descendants from a single ancestor, as well as the spouses, ex-spouses, adopted children and stepchildren of these individuals

- To be an exempt FMC that manages assets for or on behalf of the family(ies); and

- Wholly owned or controlled by members of the same family(ies)

SFO also needs to issue annual statement to its investors (for 13D/O funds)

FAQs and Clarifications

Sub-delegation arrangements

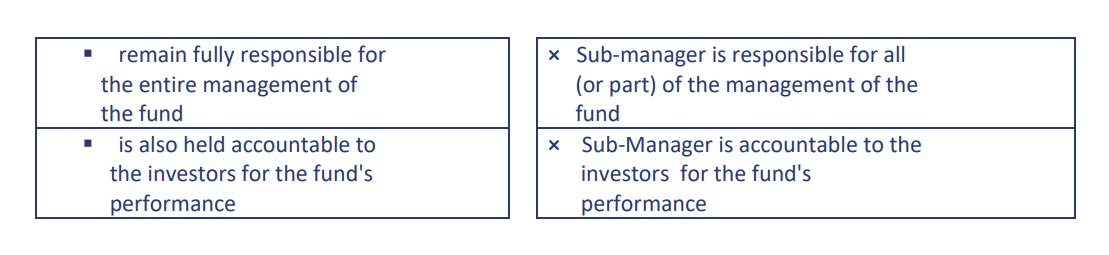

Singapore-based FMC must:-